Now You Know Prospects of Garments Industry in Bangladesh

Monday, 4 February 2019

Edit

Prospects of Garments Industry in Bangladesh

Mithun Chanda

Dept. of Textile Engineering

Mawlana Bhashani Science and Technology University

Tangail, Bangladesh

Dept. of Textile Engineering

Mawlana Bhashani Science and Technology University

Tangail, Bangladesh

Email: mithun_mw@yahoo.com

Overviews of Bangladesh Garment Industry

Agriculture, as the case in India, has been the backbone of the economy and chief source of income for the people of Bangladesh, the country made of villages.The government wants to decrease poverty by getting highest productivity from agriculture and achieve self-reliance in food production. Apart from agriculture, the country is much concerned about the growth of export division. Bangladesh has accelerated and changed her exports substantially from time to time. After Bangladesh came into being, jute and tea were the most export-oriented industries. But with the continual perils of flood, failing jute fiber prices and a considerable decline in world demand, the role of the jute sector in the country’s economy has deteriorated (Spinanger, 1986). After that, focus has been shifted to the function of the production sector, especially in the garment industry.

|

| Garment industry of Bangladesh |

The Garment industry is controlled by the transfer of production. The globalization of garment production started earlier and has expanded more than that of any other factory. The companies have transferred their blue-collar production activities from high-wage areas to low-cost manufacturing regions in industrializing countries. The enhancement of communication system and networking has played a key role in this development. Export-oriented manufacturing has brought some good returns to the industrializing nations of Asia and Latin America since the 1960s. The first relocation of garment manufacturing took place from North America and Western Europe to Japan in the 1950s and the early 1960s. But during 1965 and 1983, Japan changed its attention to more lucrative products like cars, stereos and computers and therefore, 400,000 workers were laid off by the Japanese textile industry and Garment Industry. In fact, the second floor clothing transfer from Japan to the Asian tigers – South Korea, Taiwan, Hong Kong and Singapore in 1970. But the trend of shifting production to stay there. The increase in labor costs and free trade union activities in connection with the expansion in the economies of the Asian Tigers. The sector has suffered the third shift of production from 1980s to 1990s; from the Asian Tigers to other developing countries – Philippines, Malaysia, Thailand, Indonesia and China in particular. The 1990s have been led by the final group of exporters including Bangladesh, Srilanka, Pakistan and Vietnam. But China was a leader in the current of the relocation as in less than ten years (after 1980s) China emerged from nowhere to become the world’s major manufacturer and exporter of clothing.

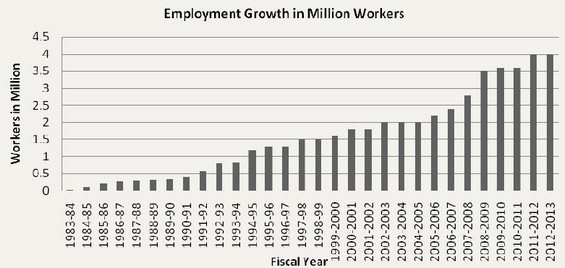

Bangladesh Garment Sector and Global Chain

The cause of this transfer can be clarified by the salary structure in the garment industry, all over the world. Apparel labor charge per hour (wages and fringe benefits, US$) in USA is 10.12 but it is only 0.30 in Bangladesh. This difference accelerated the world apparel exports from $3 billion in 1965, with developing nations making up just 14 percent of the total, to $119 billion in 1991, with developing nations contributing 59 percent. In 1991 the number of workers in the ready-made garment industry of Bangladesh was 582,000 and it grew up to 1,404,000 in 1998. In USA, however, 1991-figure showed 1,106.0 thousand workers in the apparel sector and in 1998 it turned down to 765. 8 thousand.

The presented information reveals that the tendency of low labor charges is the key reason for the transfer of garment manufacturing in Bangladesh. The practice initiated in the late 1970s when the Asian Tiger nations were in quest of tactics to avoid the export quotas of Western countries. The garment units of Bangladesh are mainly relying on the ‘tiger’ nations for raw materials. Mediators in Asian Tiger nations build an intermediary between the textile units in their home countries, where the spinning and weaving go on, and the Bangladeshi units where the cloth is cut, sewn, ironed and packed into cartons for export. The same representatives of tiger nations discover the market for Bangladesh in several nations of the North. Large retail trading companies placed in the United States and Western Europe give most orders for Bangladeshi garment products. Companies like Marks and Spencers (UK) and C&A (the Netherlands) control capital funds, in proportion to which the capital of Bangladeshi owners is patience. Shirts manufactured in Bangladesh are sold in developing nations for five to ten times their imported price.

Collaboration of a native private garment industry, Desh Company, with a Korean company, Daewoo is an important instance of an international garment chain that works as one of the grounds of the expansion of garment industry in Bangladesh. Daewoo Corporation of South Korea, as part of its global policies, took interest in Bangladesh when the Chairman, Kim Woo-Choong, offered an aspiring joint venture to the government of Bangladesh, which included the growth and process of tyre, leather goods, and cement and garment factories. The Desh-Daewoo alliance was decisive in terms of getting into world markets of the times when clothing imports hve been significant reform in this market after the signing of the Foreign Ministry in 1974. Daewoo, a South Korean exporter of clothing, was looking for opportunities in countries that barely had their share. Limiting rate for Korea of AMF, the export of Daewoo has been limited. Bangladesh as an LDC had the opportunity, without constraint and then with the use of Daewoo for exports hit Bangladeshtheir market. The purpose behind this need was that Bangladesh would rely on Daewoo for importing raw materials and at the same time Daewoo would get the market in Bangladesh. When the Chairman of Daewoo displayed interest in Bangladesh, the country’s President put him in touch with the chairman of Desh Company, an ex-civil servant who was seeking more entrepreneurial pursuits.

To fulfil this wish, Daewoo signed a collaboration contract with Desh Garment for five years. The contract also incorporated the fields of technical training, purchase of machinery and fabric, plant establishment and marketing in return for a specific marketing commission on all exports by Desh during the contract phase. Daewoo also imparted an exhaustive practical training of Desh employees in the working atmosphere of a multinational company. Daewoo keenly helped Desh in buying machinery and fabrics. Some technicians of Daewoo arrived Bangladesh to establish the plant for Desh. The end result of the association of Desh-Daewoo was important. In the first six years of its business, i.e. 1980/81-86/87, Desh export value increased at an annual average rate of 90%, reaching more than $5 million in 1986/87.

It is claimed that the Desh-Daewoo alliance is a significant element for the growth and achievement of Bangladesh’s entire garment export industry. After getting linked with Daewoo’s brand names and marketing network, overseas buyers went on with buying garments from the corporation heedless of their origin. Out of the opening trainees most left Desh Company at several times to erect their own competing garment companies, worked as a way of moving knowledge all through the whole garment sector.

It is essential to identify the outcomes of the process of moving production from higher pay to low pay nations for both developing and developed nations. It is a bare fact that most of the Third World nations are now on the way to industrialization. In this procedure, workers are working under unfavorable working environment – minimal wages, unhealthy place of work, lack of security, no job guarantee, forced labor etc.

The route of globalization is full of ups and downs for the developing nations. Relocations of comparatively mobile, blue-collar production from industrialized to developing nations, in some circumstances, can have troublesome effects on social life if – in the absence of efficient planning and talks between international organizations and the government and/or organisations of the host nation – the transferred action encourages urban-bound relocation and its span of stay is short. Another negative result is that the rise in employment and/or income is not expected to be satisfactorily large and extensive to lessen inequality. In connection with the negative results of relocation of manufacturing on employment in developed countries, we realize that in comparatively blue-collar industries, the growing imports from developing nations lead to unavoidable losses in employment. It is held that the development of trade with the South was a significant reason of the disindustrialisation of employment in the North over past few decades.

After all employees who are constantly working under unfavorable circumstances have to bear the brunt. Work is under-control across the Bangladesh garment sector.The Appalling working atmosphere has been brought to light in the Bangladesh garment industry.

A research reveals that 90 percent of the garment employees went through illness or disease during the month before the interviews. Headache, anaemia, fever, chest, stomach, eye and ear pain, cough and cold, diarrhea, dysentery, urinary tract infection and reproductive health problems were more common diseases. The garment factories gave a bonus of different diseases to the employees for working. With a view to finding out a link between these diseases and industrial threats, health status of employees has been examined before and after coming in the garment work. At the end of examination, it was coming out that about 75 percent of the garment workforce had sound health before they entered the garment factory. The reasons of health declines were industrial threats, unfavorable working environment, and want of staff facilities, inflexible terms and conditions of garment employment, workplace pressure, and low wages. Different work-related threats and their influence on health forced employees to leave the job after few months of joining the factory; the average length of service was only 4 years.

The garment sector is disreputable for fires, which are said to have claimed over 200 lives in the past two years, though exact figures are tough to find. A shocking instance of absence of workplace safety was the fire in November 2000, in which almost 50 workers lost their lives in Narsingdi as exist doors were closed.

From the above analysis of the working Atmosphere of the clothing industry, we can conclude that recall the work environment of most third world countries, in particular the development of the Garment Industry in Bangladesh before the first world countries. The level of employment in many (not necessarily) textiles and clothing units in developing countries take us back to set up in the nineteenth century in Europe and North America. The abuse of workers' clothing during the period of birth on the development of the head of the United Statesfactories reviewed above is more or less same as it seen now in the Bangladesh garment industry. Can we state that garment employees of the Third World nations living in the 21st century? Is it a return of the Sweatshop?

In a way, the Western companies are guilty of pitiable working atmosphere in the garment sector. The developed nations want to make more profit and therefore, force the developing nations to cut down the manufacturing cost. In order to survive in the competition, most of the developing nations select immoral practices. By introducing inflexible terms and conditions in the business, the global economy has left few alternatives for the developing nations.

Development of Garments Industry in Bangladesh

In the field of industrialization, role of textile industry is found very prominent in both developed and developing countries. Economic history of Britain reveals that in the 18th Century the cotton mills of Lancashire in Britain ushered in the first industrial revolution of the world. Moreover, during the last 200 years or more many countries of the world have used textile and clothing industry as an engine for growth and a basis for attaining economic development (Ahmed, 1991).

Over the past few years garment industry is found to have played such an important role in the process of industrialization and economic growth. This industry is infact trying to put the wheel of her declining economic back to the track by giving essential life blood to it (Chowdhury,1991). The growth of garment industry in Bangladesh is a comparatively recent one. In the British period there was no garment industry in this part of the Indo-Pak-Sub-Continent. In 1960 the first garment industry in Bangladesh (Then East Pakistan) was established at Dhaka and till 1971 the number rose to give (Islam, 1984). But these garments were of different type intended to serve home market only. From 1976 and 1977 some entrepreneurs came forward to setup 100% export oriented garment industry.

Both domestic and international environment favored the rapid growth of this industry in Bangladesh. By mid seventies the established developed suppliers of garments in the world markets i.e. Hong Kong, South Korea, Singapore, Taiwan, Thailand, Malaysia, Indonesia, Srilanka and India were severely constrained by the quota restrictions imposed by their major buyers like USA, Canada and European Union. To maintain their business and competitive edge in the world markets, they followed a strategy of relocation of garment factories in those countries, which were free from quota restrictions and at least same time had enough trainable cheap labour. They found Bangladesh as one of the most suitable countries. Available records show that the first consignment of garments was exported from the country in 1977 by Reaz and Jewel Garment. Desh Garment was the first biggest factory that started functioning at Chittagong in 1977. In fact that was the humble beginning of new joint venture garment factory in Bangladesh. Thereafter many entrepreneurs became interested and started to setup garment factories following the Desh garment and realising the future prospects globally as well. Available records also show that one of the reasons of the growth of garment industry in Bangladesh is the collaboration of a local private garment industry, Desh garment with a Korean company, Daewoo. As part of its global strategies, the Daewoo Corporation of South Korea became interested in Bangladesh when the Chairman, Kim Woo-Choong, proposed an ambitions joint venture to the Government of Bangladesh which involved the development and operation of tyre, leather goods, cement and garment factories (Rock, 2001). South Korean Company, Daewoo, a major exporter of garments, was looking for opportunities in countries for using their quotas subsequent to the signing of MFA in 1974. Because of the quota limitation for Korea after MFA, the export of Daewoo became restricted.

Bangladesh as a LDC got the opportunity to export without any restriction and for this reason Daewoo interested to use Bangladesh for their market. The reason behind this desire was that Bangladesh will depend on Daewoo for importing raw materials and at the same time Daewoo will get the market in Bangladesh. For this desire Daewoo signed a five years collaboration agreement with Desh Garment. It included collaboration in the areas of technical training, purchase of machinery and fabric, plant setup and marketing in return for a specific marketing commission on all exports by Desh (Rock, 2001). The outcome of the collaboration of Desh-Daewoo was significant. In the first six years of its operation, Desh export value grew at an annual average rate of 90 percent reaching more than $ 5 million in 1986-87 (Mahmood, 2002). Rahman (2004) argued that the Desh-Daewoo collaboration is an important factor to the expansion and success of Bangladesh’s entire garments export sector. In such a context, following Table-01 shows the trend of growth and development of garment industry in Bangladesh.

Table1: Growth of RMG factories and employment in Bangladesh

The capacity as well as number of equipments is very good indicator to examine the actual position of the garment industry as well as size of the industry. In such a context, the following Table deals in this regard.

Table-2: Garments Industries with number of Machine

Source: Annual Report of BGMEA. Figures in parentheses indicate percentage

From the Table 02 it is found that more than half of the total garment industries in Bangladesh have the number of machines upto 100 or less than 100 and very few industries have the machine more than 200. It indicates that the small scale industries have been dominated in the garment sector.

Contribution of Garments Industry to the Economy

Garments Industry occupies a unique position in the Bangladesh economy. It is the largest exporting industry in Bangladesh, which experienced phenomenal growth during last two decades. By taking advantage of an insulated market under the provision of Multi Fibre Agreement (MFA) of GATT, it attained a high profile in terms of foreign exchange earnings, exports, industrialisation and contribution to GDP within a short span of time. The industry plays a key role in employment generation and in the provision of income to the poor. Nearly two million workers one directly and more than ten million inhabitants are indirectly associated with the industry (Ahmed and Hossain, 2006). The sector has also played a significant role in the socio-economic development of the country. In such a context, the trend and growth of garments export and its contribution to total exports and GDP has been examined the following table shows the position.

Source: Economic Review of Bangladesh, BGMEA and Computation made by author. Figures in parentheses indicate compound growth rates (CGR) for the respective periods.

It is revealed from the Table 03 that the value of garment exports, share of garments export to total exports and contribution to GDP have been increased significantly during the period from 1984-85 to 2005-06. The total garments export in 2005-06 is more than 68 times compared to garments exports in 1984-85 whereas total country’s export for the same period has increased by 11 times. In terms of GDP, contribution of garments export is significant; it reaches 12.64 percent of GDP in 2005-06 which was only 5.87 percent in 1989-90. It is a clear indication of the contribution to the overall economy. It also plays a pivotal role to promote the development of linkage small scale industries. For instance, manufacturing of intermediate product such as dyeing, printing, zippers, labels has began to take a foothold on limited scale and is expected to grow significantly. Moreover, it has helped the business of basling, insurance, shipping, hotel, tourism and transportation. The sector also has created jobs for about two million people, of which 70 percent are women who mostly come from rural areas. The sector opened up employment opportunities for many more individuals through direct and indirect economic activities, which eventually helps the country’s social development, woman empowerment and poverty alleviation. In such a way the economy of Bangladesh is getting favorably contribution from this industry.

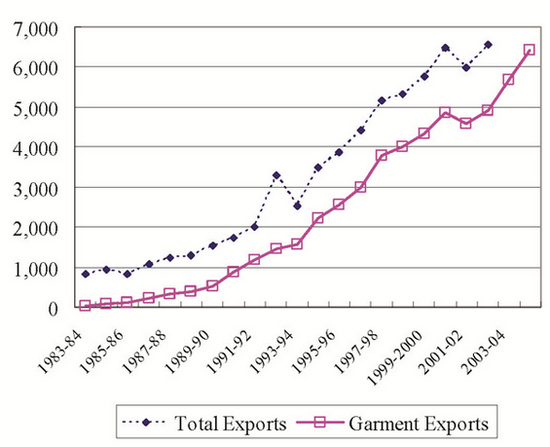

Garment Exports from Bangladesh (Million US Dollars)

Export-oriented garment exports from Bangladesh were initiated in the beginning of the 1980s (Bhattacharya and Rahman, 2001; Hoque, Murayama and Rahman, 1995; Murayama, 2006; Rhee, 1990; Zohir and Paul-Majumder, 1996). A Korean investor was deeply involved in the inception of the business in Bangladesh. In the first half of the 1980s the number of garment exports from Bangladesh was almost nil (Figure). But then garment exports grew rapidly, so that in the beginning of the 1990s garments made up about a half of total exports from Bangladesh. The growth has continued almost without interruption and the value of garment exports reached three-quarters of the value of total exports at the end of the 1990s. Though a negative impact from September 11 is apparent in 2001, garment exports quickly picked up after that. Thus, the rapid growth of garment exports has continued for a quarter of a century with little disturbance.

Post MFA Scenario in Bangladesh

The textile and apparel industries have led industrializatio n at the early stage of development in many countries of the world. Most developed countries which have lost competitiveness have imposed quantitative restrictions on the trade in textiles and clothing since the 1950s, although there has been progress in trade liberalization as a whole. Over the last thirty years, international trade and investment in the global textile and garment (T&G) sectors has been influenced by Multi-Fiber Agreement (MFA) quantitative restrictions (quotas) applied by the major developed country importers (the United States, the European Union, Canada and Norway) on T&G exports from (predominantly) developing countries. MFA quotas were negotiated bilaterally and applied on a discriminatory basis to some exporting countries but not to others, thus differing from country to country in both product coverage and the degree of restrictiveness. In such a context, the Multi-Fiber Arrangement governed the trade in textiles and clothing from 1974 to 1994. This arrangement was superseded in 1995 by the Agreement on Textiles and Clothing (ATC) under the administration of the World Trade Organization (WTO). From 1 January 2005 all such quantitative restrictions on the trade in textiles and clothing were phased out, and finally abolished. Historically speaking that as per requirement of The ATC, all MFA quotas on T&G products be removed over a ten-year transition period split into three phases and ending on 1 January 2005, thus finally incorporating international T&G trade into general GATT rules that prohibit discriminatory measures and call for the reduction and elimination of quantitative restrictions.

Table1: Growth of RMG factories and employment in Bangladesh

|

| Source: Various articles and Annual Report of BGMEA. |

Table-2: Garments Industries with number of Machine

| Year | Garment Industry having No of Machine | Total | ||

| 2004 2005 | Upto 100 | 101 – 200 | 201 and over | 3510 (100) 3668 (100) |

| 2253 (64) 2275 (62) | 726 (21) 773 (21) | 531 (15) 620 (17) | ||

From the Table 02 it is found that more than half of the total garment industries in Bangladesh have the number of machines upto 100 or less than 100 and very few industries have the machine more than 200. It indicates that the small scale industries have been dominated in the garment sector.

Contribution of Garments Industry to the Economy

Garments Industry occupies a unique position in the Bangladesh economy. It is the largest exporting industry in Bangladesh, which experienced phenomenal growth during last two decades. By taking advantage of an insulated market under the provision of Multi Fibre Agreement (MFA) of GATT, it attained a high profile in terms of foreign exchange earnings, exports, industrialisation and contribution to GDP within a short span of time. The industry plays a key role in employment generation and in the provision of income to the poor. Nearly two million workers one directly and more than ten million inhabitants are indirectly associated with the industry (Ahmed and Hossain, 2006). The sector has also played a significant role in the socio-economic development of the country. In such a context, the trend and growth of garments export and its contribution to total exports and GDP has been examined the following table shows the position.

Table-3: Growth and Trend of Garments Exports, and contribution to GDP (Amounts in Million USD)

| Year | Garment Export (Min USD) | Total Export (Min USD) | Share to Total Export in % | Share to GDP in % |

| 1984-85 1989-90 1994-95 1999-00 2004-05 2005-06 | 116 - 624 (40) 2228 (29) 4349 (14) 6418 (8) 7901 (23) | 934 - 1924 (16) 3473 (13) 5752 (11) 8655 (9) 10526 (22) | 12.42 - 32.43 (21) 64.15 (15) 75.61 (3) 74.15 (-1) 75.06 (1) | - - 5.87- 9.23 (9) 10.63 (3) 12.64 (2) |

It is revealed from the Table 03 that the value of garment exports, share of garments export to total exports and contribution to GDP have been increased significantly during the period from 1984-85 to 2005-06. The total garments export in 2005-06 is more than 68 times compared to garments exports in 1984-85 whereas total country’s export for the same period has increased by 11 times. In terms of GDP, contribution of garments export is significant; it reaches 12.64 percent of GDP in 2005-06 which was only 5.87 percent in 1989-90. It is a clear indication of the contribution to the overall economy. It also plays a pivotal role to promote the development of linkage small scale industries. For instance, manufacturing of intermediate product such as dyeing, printing, zippers, labels has began to take a foothold on limited scale and is expected to grow significantly. Moreover, it has helped the business of basling, insurance, shipping, hotel, tourism and transportation. The sector also has created jobs for about two million people, of which 70 percent are women who mostly come from rural areas. The sector opened up employment opportunities for many more individuals through direct and indirect economic activities, which eventually helps the country’s social development, woman empowerment and poverty alleviation. In such a way the economy of Bangladesh is getting favorably contribution from this industry.

The Ranking of Export in U.S.A Comparing to Other in 2005

It is noteworthy that even during the high time for China, when it entertained an extremely high growth in garment exports in the first half of 2005, Bangladesh and Cambodia maintained a high 20 to 30 percent level of growth in garment exports to the United States. Their growth rates were generally a little below that of India during the year. However, they are distinct from Vietnam, whose growth rates were negative during the second and third quarters of 2005 and where positive growth was recovered only after the renewal of the quantitative restriction system on China’s garment exports to the United States. In other words, the steady growth in garment exports from Bangladesh and Cambodia looks robust compared to what occurred in China. Garment Exports from Bangladesh (Million US Dollars)

|

| Source: MOF (2005). |

Post MFA Scenario in Bangladesh

The textile and apparel industries have led industrializatio n at the early stage of development in many countries of the world. Most developed countries which have lost competitiveness have imposed quantitative restrictions on the trade in textiles and clothing since the 1950s, although there has been progress in trade liberalization as a whole. Over the last thirty years, international trade and investment in the global textile and garment (T&G) sectors has been influenced by Multi-Fiber Agreement (MFA) quantitative restrictions (quotas) applied by the major developed country importers (the United States, the European Union, Canada and Norway) on T&G exports from (predominantly) developing countries. MFA quotas were negotiated bilaterally and applied on a discriminatory basis to some exporting countries but not to others, thus differing from country to country in both product coverage and the degree of restrictiveness. In such a context, the Multi-Fiber Arrangement governed the trade in textiles and clothing from 1974 to 1994. This arrangement was superseded in 1995 by the Agreement on Textiles and Clothing (ATC) under the administration of the World Trade Organization (WTO). From 1 January 2005 all such quantitative restrictions on the trade in textiles and clothing were phased out, and finally abolished. Historically speaking that as per requirement of The ATC, all MFA quotas on T&G products be removed over a ten-year transition period split into three phases and ending on 1 January 2005, thus finally incorporating international T&G trade into general GATT rules that prohibit discriminatory measures and call for the reduction and elimination of quantitative restrictions.

The quota system under the MFA has distorted international T&G trade and has resulted in global welfare losses since quota limits on the exports of selective producers have prevented an allocation of resources to the most efficient T&G producers and prevented prices in quota protected developed country markets from falling. Competitive exporting countries with comparative advantages in T&G production have been restrained from expanding under the MFA quota system, while relatively uncompetitive producers have enjoyed guaranteed market access (up to the quota limit) to developed country markets (Spinanger, 1999). In such a context, there was serious concern that low income countries, such as Bangladesh, Cambodia and the like, which relied heavily on the garment industry, would suffer from the keen competition expected to be triggered by the complete liberalization of trade in textiles and clothing from the beginning of 2005. From the many corners it was predicted that China would expand its exports and India would follow, and that the other relatively small exporters would suffered seriously from the competition of these two giants. However, it turned out that some garment-exporting Least Developed Countries (LDCs), such as Bangladesh, Cambodia and Haiti, faired very well throughout the year 2005. In this context, an attempt has been made to examine the export data of selected countries during MFA and post MFA to US and EU markets in order to assess the indicative impact of post MFA scenario in Bangladesh as well as other largest garments exporters. The following Tables show the picture in this regard.

Table-4: Exports of Knit and Woven Garments to the United States

Source: U.S. Department of Commerce, Bureau of Census cited in Yamagata, 2006

Table-5: Exports of Knit and Woven Garments to the EU

Source: Eurostat cited in Yamagata, 2006.

Tables 4 and 5 show the trends in garment exports to the United States and EU from the five largest garment exporters and the two leading exporters among the LDCs, Bangladesh and Cambodia. It was revealed that China and India expanded garment exports to the US and EU, the world’s two largest markets. Along with China and India, Bangladesh and Cambodia have also increased their exports to the United States during 2005 by more than 20 percent. Though their garment exports to the EU declined between 2004 and 2005, the drops were not significant; and the growth in the same figures by more than 30 percent between 2003 and 2004 surpassed the decline in 2005 (Table 5). As a whole, the sum of garment exports to the two largest markets grew by 2.54 percent for Bangladesh and by 11.06 percent for Cambodia in 2005. Since the US and EU are going to be imposing new restrictions on textile and garment imports from China for at least a couple of years, exports from that country will slow down, making room for the remaining garment exporters to increase growth. Thus, the prospects for Bangladesh to continue expanding its garment exports are encouraging.

Bangladesh overtakes India in RMG exports

Bangladesh has overtaken India in readymade garment exports despite the recent setbacks it received like instances of building collapses and fire at manufacturing units, says a study by Exim Bank.

Between January and October 2013, readymade shipments by Indian exporters to the US grew 6.3 per cent to $3.2 billion, while the same by Bangladesh jumped 11.4 per cent at $4.9 billion, the premier export finance agency said, reports The Economic Times.

“In the absence of latest data, imports by the US are a very good benchmark of understanding the latest trends. Bangladesh has been aggressively pushing the garment exports and has made a slew of policy changes to facilitate those,” Exim Bank Chief General Manager Prahalathan Iyer told PTI.

Bangladesh’s garment exports increased from $6.8 billion in 2005 to $19.9 billion in 2012, recording a compounded annual growth rate (CAGR) of 16.6 per cent. During the same period, India’s outward shipments rose from $8.7 billion to $13.8 billion, a CAGR of just 6.8 per cent.

Iyer and his colleagues conducted a study, which revealed that Bangladesh offers sops like uninterrupted power and a priority at the Chittagong port for shipment. “They have to take it very seriously as the garment exports contribute 80 per cent of Bangladesh’s total export earnings.”

Asked if recent events like a spate of fires and collapse of garment factories, which led to some anxiety over safety norms at these units among the Western retailers sourcing goods from the country’s eastern neighbour, is favourable for India, Iyer replied in the negative.

He said in October 2013, because of these incidents, there was a slowdown in Bangladeshi garment exports, which grew only 3 per cent. But initial trends point out to a robust growth of over 41 per cent in November, suggesting a healthy bounce back by the key sector.

Iyer said many of the sourcing companies have South Asia offices situated in India, but they source garments from either Bangladesh or Sri Lanka.

High Profitability on Average

The similarity is in the high average profitability of the export-oriented garment business. This observation is based on two firm-level surveys conducted by the Institute of Developing Economies (IDE) in cooperation with research institutes in Bangladesh and Cambodia (Fukunishi et al., 2006; Yamagata, 2006b).

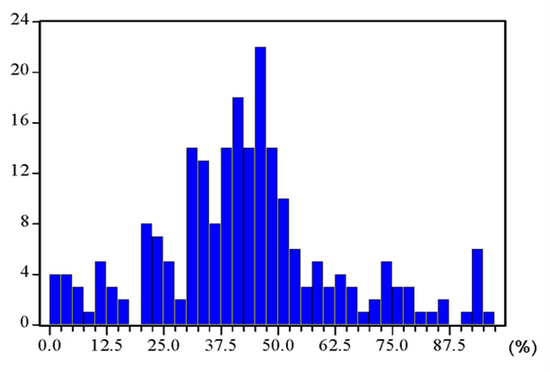

Figure 5. Distribution of Firms by Profit-to-Sales Ratio: Bangladesh

No. of firms

Figures are diagrams depicting the two data sets which are comprised of 222 sample firms for Bangladesh and 164 sample firms for Cambodia. Details on the data for Bangladesh can be found in Fukunishi et al. (2003), and for Cambodia, in Yamagata (2006b). Both diagrams are histograms of the sample firms by profit-to-sales ratio.9 It is evident fromFigure 5 that there were many firms with considerably high profit-to-sales ratios in Bangladesh in 2003. Most of the sample firms exhibit profit-to-sales ratios as high as 30 to 50 percent. There happened to be no sample firms recording negative profits in this data set.

Now A Days The Structure of Textile Industry of Bangladesh

Source: 2008 Bangladesh Textile MIlls Association

Conclusion

Bangladeshi Garment Industry is the largest industrial sector of the country. Though the history of Readymade Garment Industry is not older one but Bangladeshi clothing business has a golden history. Probably it started from the Mughal age in the Indian subcontinent through Dhakai Musline. It had global reputation as well as demandable market around the globe especially in the European market.

After industrial revolution in the west they were busy with technological advancement & started outsourcing of ready made garments to meet up their daily demands. Many LDC's took that chance & started ready made garment export at that markets. As an LDC Bangladesh took this chance enjoyed quota & other facilities of them. Thus ready made garment industry started to contribute in our economy from late eighties (1977).

The history of the garment industry dates back to 1977 when the first consignment was exported to then West Germany by Jewel Garments. The number of units, however, remained a meager 46 until the end of 1983. From a humble beginning the sector has thus made phenomenal growth over the last two decades, the number of units growing to around 4500. The RMG industry achievement is noteworthy, particularly for a country plagued with poor resource endowments and adverse conditions for industrialization. Exports increased from approximately 32 million US dollars in 1983/84 to 1.4 billion dollars in 1992/93. In 1987/88, the RMG export share surpassed that of raw jute and allied products. The figure further rose to 5.7 billion dollars in 2003/04, representing a contribution of about 75 percent of the country's total export earnings in that year. The employment generated by the sector is estimated to be around 1.5 million workers.

Several factors account for the outstanding successes of the RMG industry in Bangladesh. At the same time this industry had faced & till facing many problems also. These problems & prospects of RMG industry in Bangladesh is my topic to find out as well as to make critical analysis on these.

Here I use data from different sources like, BGMEA, BKMEA, CPD, World Bank, UNDP, Lmd Journal Published by Australian National University, CIA Report, ADB, Bureau of Economic Research - University of Dhaka, The University of Chicago Press & many other sources stated in reference section.

References:

Table-4: Exports of Knit and Woven Garments to the United States

| Rank | Origin | Amount (Million US$) | Rate of Change (%) | |||

| 2003 | 2004 | 2005 | 2003-04 | 2004-05 | ||

| 1 2 3 4 5 6 | China Mexico Hong Kong India Indonesia Bangladesh | 8,690 7,098 3,732 2,056 2,155 1,759 | 10,723 6,845 3,878 2,277 2,402 1,872 | 16,808 6,230 3,523 3,058 2,882 2,268 | 23.39 -3.56 3.93 10.74 11.47 6.45 | 56.75 -8.98 -9.16 34.29 19.99 21.15 |

Table-5: Exports of Knit and Woven Garments to the EU

| Rank | Origin | Amount (Million US$) | Rate of Change (%) | |||

| 2003 | 2004 | 2005 | 2003-04 | 2004-05 | ||

| 1 2 3 4 5 19 | All Countries China Turkey Bangladesh Romania India Cambodia | 56,918 10,913 8,112 3,471 4,124 2,599 475 | 65,552 13,714 9,348 4,578 4,572 3,020 643 | 69,642 20,334 9,790 4,346 4,285 3,988 587 | 15.17 25.66 15.24 31.90 10.87 16.23 35.27 | 6.24 48.27 4.72 -5.08 -6.28 32.02 -8.77 |

Tables 4 and 5 show the trends in garment exports to the United States and EU from the five largest garment exporters and the two leading exporters among the LDCs, Bangladesh and Cambodia. It was revealed that China and India expanded garment exports to the US and EU, the world’s two largest markets. Along with China and India, Bangladesh and Cambodia have also increased their exports to the United States during 2005 by more than 20 percent. Though their garment exports to the EU declined between 2004 and 2005, the drops were not significant; and the growth in the same figures by more than 30 percent between 2003 and 2004 surpassed the decline in 2005 (Table 5). As a whole, the sum of garment exports to the two largest markets grew by 2.54 percent for Bangladesh and by 11.06 percent for Cambodia in 2005. Since the US and EU are going to be imposing new restrictions on textile and garment imports from China for at least a couple of years, exports from that country will slow down, making room for the remaining garment exporters to increase growth. Thus, the prospects for Bangladesh to continue expanding its garment exports are encouraging.

Bangladesh overtakes India in RMG exports

Bangladesh has overtaken India in readymade garment exports despite the recent setbacks it received like instances of building collapses and fire at manufacturing units, says a study by Exim Bank.

Between January and October 2013, readymade shipments by Indian exporters to the US grew 6.3 per cent to $3.2 billion, while the same by Bangladesh jumped 11.4 per cent at $4.9 billion, the premier export finance agency said, reports The Economic Times.

“In the absence of latest data, imports by the US are a very good benchmark of understanding the latest trends. Bangladesh has been aggressively pushing the garment exports and has made a slew of policy changes to facilitate those,” Exim Bank Chief General Manager Prahalathan Iyer told PTI.

Bangladesh’s garment exports increased from $6.8 billion in 2005 to $19.9 billion in 2012, recording a compounded annual growth rate (CAGR) of 16.6 per cent. During the same period, India’s outward shipments rose from $8.7 billion to $13.8 billion, a CAGR of just 6.8 per cent.

Iyer and his colleagues conducted a study, which revealed that Bangladesh offers sops like uninterrupted power and a priority at the Chittagong port for shipment. “They have to take it very seriously as the garment exports contribute 80 per cent of Bangladesh’s total export earnings.”

Asked if recent events like a spate of fires and collapse of garment factories, which led to some anxiety over safety norms at these units among the Western retailers sourcing goods from the country’s eastern neighbour, is favourable for India, Iyer replied in the negative.

He said in October 2013, because of these incidents, there was a slowdown in Bangladeshi garment exports, which grew only 3 per cent. But initial trends point out to a robust growth of over 41 per cent in November, suggesting a healthy bounce back by the key sector.

Iyer said many of the sourcing companies have South Asia offices situated in India, but they source garments from either Bangladesh or Sri Lanka.

High Profitability on Average

The similarity is in the high average profitability of the export-oriented garment business. This observation is based on two firm-level surveys conducted by the Institute of Developing Economies (IDE) in cooperation with research institutes in Bangladesh and Cambodia (Fukunishi et al., 2006; Yamagata, 2006b).

Figure 5. Distribution of Firms by Profit-to-Sales Ratio: Bangladesh

No. of firms

|

| Profit-to-Sales Ratio |

Now A Days The Structure of Textile Industry of Bangladesh

| Sub Sector | No. of Units | Installed Machine Capacity | Production Capacity(In Mill.) |

| | | | |

| Yarn Manufacturing Mill (Spinning) (a) Private - BTMA (b) Public - BTMC Silk Manufacturing Mill: 01 Synthetic Yarn Manufacturing Mill: 12 Acrylic Yarn Manufacturing Mill: 09 Wool Manufacturing Mill: 02 | 301 23 | 6.32 Mill. Spindle 0.45 Mill. Spindle 0.218 Mill. Spindle | 1,300 Kgs. 40 Kgs |

| Total | 324 | | 1340 Kg. |

| Weaving (Large Mill) Private Sector | 420 | 25000 Shuttleless/ Shuttle Loom | 1,400 M. Mtr. |

| Spl. Textiles & Powerloom: Private Sector | 1,065 | 23000 Shuttleless/ Shuttle Loom | 300 M. Mtr. |

| Total | 1485 | 48000 Shuttleless/ Shuttle Loom | 1700 M. Mtr. |

| Handloom (GF/F) | 148342 | 498000 Handloom | 837.00 M. Mtr. |

| Knitting, Knit Dyeing (GF) (a) Export Oriented (b) Local Market | 800 2000 | 12000 Knit/Knit Dyeing / Machine 5000 Knit/Knit Dyeing /Machine | 3600 M. Mtr. 500 M. Mtr. |

| | | | |

| Total | 2800 | 17000 Knit/Knit Dyeing / Machine | 4100 M. Mtr. |

| | | | |

| Wet Processing Industry Knitting, Knit Dyeing (GF) | | | |

| | | | |

| (a) Export Oriented (b) Local Market | 1000 2000 | 14000 Knit/Dyeing Machine 5000 Knitting Machine | 3600 M. Mtr. 500 M. Mtr. |

| | | | |

| Total | 3000 | 19000 Knit/Dyeing Machine | 4100 M. Mtr. |

| | | | |

| Dyeing & Finishing (GF) | | | |

| | | | |

| (a) Semi - Machinized (b) Machinized | 180 130 | | 1200 M. Mtr. 1600 M. Mtr. |

| | | | |

| Total | 310 | | 2800 M. Mtr. |

| | | | |

| Export Oriented RMG | 4500 | | 475 Dozens |

Conclusion

Bangladeshi Garment Industry is the largest industrial sector of the country. Though the history of Readymade Garment Industry is not older one but Bangladeshi clothing business has a golden history. Probably it started from the Mughal age in the Indian subcontinent through Dhakai Musline. It had global reputation as well as demandable market around the globe especially in the European market.

After industrial revolution in the west they were busy with technological advancement & started outsourcing of ready made garments to meet up their daily demands. Many LDC's took that chance & started ready made garment export at that markets. As an LDC Bangladesh took this chance enjoyed quota & other facilities of them. Thus ready made garment industry started to contribute in our economy from late eighties (1977).

The history of the garment industry dates back to 1977 when the first consignment was exported to then West Germany by Jewel Garments. The number of units, however, remained a meager 46 until the end of 1983. From a humble beginning the sector has thus made phenomenal growth over the last two decades, the number of units growing to around 4500. The RMG industry achievement is noteworthy, particularly for a country plagued with poor resource endowments and adverse conditions for industrialization. Exports increased from approximately 32 million US dollars in 1983/84 to 1.4 billion dollars in 1992/93. In 1987/88, the RMG export share surpassed that of raw jute and allied products. The figure further rose to 5.7 billion dollars in 2003/04, representing a contribution of about 75 percent of the country's total export earnings in that year. The employment generated by the sector is estimated to be around 1.5 million workers.

Several factors account for the outstanding successes of the RMG industry in Bangladesh. At the same time this industry had faced & till facing many problems also. These problems & prospects of RMG industry in Bangladesh is my topic to find out as well as to make critical analysis on these.

Here I use data from different sources like, BGMEA, BKMEA, CPD, World Bank, UNDP, Lmd Journal Published by Australian National University, CIA Report, ADB, Bureau of Economic Research - University of Dhaka, The University of Chicago Press & many other sources stated in reference section.

References:

- Garments & Technology By M. A. Kashem

- http://www.icmab.org.bd/component/option,com_docman/task,doc_download/gid,33/Itemid,93/

- Bangladesh Garment manufacturers & Export Association (BGMEA).

- Bangladesh Garments Industry.

- http://www.apparel.com.bd/?p=4273