Now You Know Overview of the Vietnam Textile and Garment Industry

Overview of the Vietnam Textile and Garment Industry

Nguyễn Thị Danh

Hanoi University of Science and Technology, Vietnam

Email: nguyenthidanh94@gmail.com

Hanoi University of Science and Technology, Vietnam

Email: nguyenthidanh94@gmail.com

Introduction

Textile industry is an industry with a long tradition in Vietnam. This is an important sector in the economy of our country because it serves the basic needs of human beings, is the industry solves many jobs for the society and in particular it is the sector with strengths in export, create conditions for economic development, contributing to the balance of imports and exports from the country. Textiles and garment products is one of the most important sectors for Vietnamese export and outsourcing of production. In the process of international economic integration, the textile sector, as proved to be a key sector in the economy was reflected in exports continued to increase even during the years of crisis, the market is always wide open, the number of employees in the industry and more and a large proportion of the industry, the value of the sector's contribution to national income ... however facing relentless volatility of world economies, Textile industry is facing opportunities and great challenges.

Textile industry is an industry with a long tradition in Vietnam. This is an important sector in the economy of our country because it serves the basic needs of human beings, is the industry solves many jobs for the society and in particular it is the sector with strengths in export, create conditions for economic development, contributing to the balance of imports and exports from the country. Textiles and garment products is one of the most important sectors for Vietnamese export and outsourcing of production. In the process of international economic integration, the textile sector, as proved to be a key sector in the economy was reflected in exports continued to increase even during the years of crisis, the market is always wide open, the number of employees in the industry and more and a large proportion of the industry, the value of the sector's contribution to national income ... however facing relentless volatility of world economies, Textile industry is facing opportunities and great challenges.

|

| Vietnamese garment industry |

The textile products of Vietnam have been exported to 180 countries and territories around the world. Particularly in the first six months of 2015, textile exports Vietnam continues to maintain two-digit growth, reaching 12.18 billion US dollars, up 10.26% compared with the same period of 2014.

Growth

|

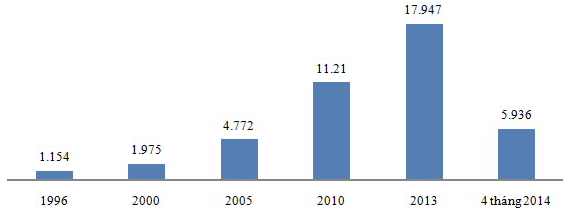

| Chart textile exports over the years (billion) - Sources: TCKT |

Vietnam's Textile and Garment Industry has seen fast and sustainable growth over the past years, playing an imperative role in the nation's socio-economic development. In 2012, the sector gained US$17.2 billion in export turnover, posting a year-on-year increase of 8.5%. The textile and garment sector plans to maintain a growth rate of nearly 10 - 12% and attain US$ 18.5-19 billion in 2013, as per Vietnam National Textile and Garment Group (Vinatex). Vietnam also expects to pocket US$ 8.5 billion from shipments to the US market (up 11%); around US$ 2.4 billion from Japan (up 18%); US$ 1.5 billion from the Republic of Korea (up 15%); US$ 2.4 billion from the EU and US$ 4.2 billion from other markets by the end of 2013.

Prospects for the sector

It can be said, textile is one of the bright spots in the picture of Vietnam's exports in 2014. The strong growth in exports has boosted the trade balance of the sector towards a surplus. With average export value reached USD 1.955 billion / month, experts said that in 2014 Vietnam's garment industry may finish exceeded $ 1 billion. Commenting on this possibility, Mr. Le Tien Truong, General Director of Vietnam National Textile Garment Group said: in 2014, the textile industry is capable of exceeding the target of 0.5-1 billion USD export growth 15-16% compared to the 12% target set. Particularly Vietnam Textile Group also expects exports to reach US $ 3.4 billion worth of goods.

Strengths of the Vietnam textile and garment industry

Vietnam’s textile and garment sector has seen fast and sustainable growth over the past years, playing an important role in national socio-economic development. Demand for labor in the sector is huge. Every year, the sector gives employment for 2.2 million people, generating income for the workers. Export value of textile and garment products in recent years has been ranking number two in the country’s total export revenue, earning a major source of foreign exchange and contributing significantly to Vietnam’s gross national product and budget.

Vietnam has advantages: only small investment capital required; a quick playback period because of short capital turnover; lots of preferential policies from the State because of providing much employment; and large domestic consumption - Vietnam is home to a population of almost 90 million. Related to the latter, there is a vast pool of young, skilled Vietnamese workers more than willing to work for low wages.

Vietnam’s joining the WTO in 2007 provided it tremendous opportunity to develop. Vietnam receives equal treatment and benefits in preferential trade just like other members of WTO; further, it can access world markets conveniently. Right away, the textile and garment sector took strong and stable development steps. Vietnam is a top 10 country in textile and garment exports. Despite the recent global economic downturn, the sector is seeing impressive export performance. Export revenue exceeded US$11 billion in 2010, up 24% against 2009, US$14 billion in 2011, accounting for 16.5% of the country's total export revenue and up 38% against 2010.

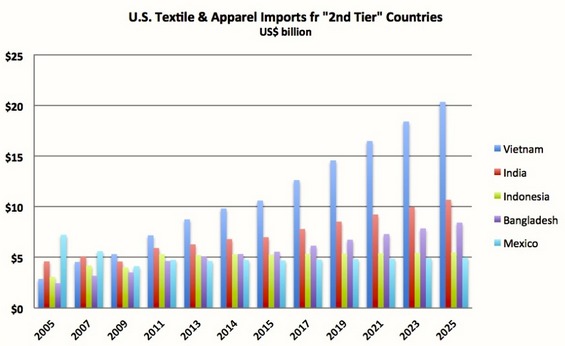

Vietnam can be proud of this commendable performance. Consider that its textile industry was the only sector in the country to maintain its overall growth and export earnings compared to the previous year. This resulted largely from the sector’s maintaining its traditional export markets (the US, EU, Japan), and expanding to new export markets (Korea, Taiwan, the Middle East, and Singapore) as well as marketing to the domestic market. The sector targets to ship US$15 billion in 2012, an increase of 11% against 2011. From the following chart we can get clear concept of the apparel export position of Vietnam.

Prospects for the sector

It can be said, textile is one of the bright spots in the picture of Vietnam's exports in 2014. The strong growth in exports has boosted the trade balance of the sector towards a surplus. With average export value reached USD 1.955 billion / month, experts said that in 2014 Vietnam's garment industry may finish exceeded $ 1 billion. Commenting on this possibility, Mr. Le Tien Truong, General Director of Vietnam National Textile Garment Group said: in 2014, the textile industry is capable of exceeding the target of 0.5-1 billion USD export growth 15-16% compared to the 12% target set. Particularly Vietnam Textile Group also expects exports to reach US $ 3.4 billion worth of goods.

Strengths of the Vietnam textile and garment industry

Vietnam’s textile and garment sector has seen fast and sustainable growth over the past years, playing an important role in national socio-economic development. Demand for labor in the sector is huge. Every year, the sector gives employment for 2.2 million people, generating income for the workers. Export value of textile and garment products in recent years has been ranking number two in the country’s total export revenue, earning a major source of foreign exchange and contributing significantly to Vietnam’s gross national product and budget.

Vietnam has advantages: only small investment capital required; a quick playback period because of short capital turnover; lots of preferential policies from the State because of providing much employment; and large domestic consumption - Vietnam is home to a population of almost 90 million. Related to the latter, there is a vast pool of young, skilled Vietnamese workers more than willing to work for low wages.

Vietnam’s joining the WTO in 2007 provided it tremendous opportunity to develop. Vietnam receives equal treatment and benefits in preferential trade just like other members of WTO; further, it can access world markets conveniently. Right away, the textile and garment sector took strong and stable development steps. Vietnam is a top 10 country in textile and garment exports. Despite the recent global economic downturn, the sector is seeing impressive export performance. Export revenue exceeded US$11 billion in 2010, up 24% against 2009, US$14 billion in 2011, accounting for 16.5% of the country's total export revenue and up 38% against 2010.

Vietnam can be proud of this commendable performance. Consider that its textile industry was the only sector in the country to maintain its overall growth and export earnings compared to the previous year. This resulted largely from the sector’s maintaining its traditional export markets (the US, EU, Japan), and expanding to new export markets (Korea, Taiwan, the Middle East, and Singapore) as well as marketing to the domestic market. The sector targets to ship US$15 billion in 2012, an increase of 11% against 2011. From the following chart we can get clear concept of the apparel export position of Vietnam.

|

| U.S. Textiles and Apparel Imports from “2nd Tier Countries” |

Source: US Department of Commerce Apparel Imports Data

Such achievements are attributable to enterprises' competency in building up and consolidating partnership with major importers throughout the world, while taking advantage of Vietnam’s abundant low-cost but skilled labor force. There are promising signs for the garment and textile industry as the global economy is bouncing back.

The Vietnam Textile and Garment Association (VITAS) notes the strategy for Vietnam Textile and Garment Industry development for 2015-2020 is: (i) production growth from 12-14% a year, (ii) export growth at 15% a year, (iii) providing employment to 2.75 million people in 2015 and 3.0 million people in 2020, and (iv) export revenue attaining US $18 billion dollars in 2015 and US $25 billion dollars in 2020.

Strengths

Such achievements are attributable to enterprises' competency in building up and consolidating partnership with major importers throughout the world, while taking advantage of Vietnam’s abundant low-cost but skilled labor force. There are promising signs for the garment and textile industry as the global economy is bouncing back.

The Vietnam Textile and Garment Association (VITAS) notes the strategy for Vietnam Textile and Garment Industry development for 2015-2020 is: (i) production growth from 12-14% a year, (ii) export growth at 15% a year, (iii) providing employment to 2.75 million people in 2015 and 3.0 million people in 2020, and (iv) export revenue attaining US $18 billion dollars in 2015 and US $25 billion dollars in 2020.

Strengths

- Plentiful competitively-priced labor - Vietnamese salaries are lower than those in China, giving the country a distinct cost advantage; and

- Supportive government policies, including incentives to attract foreign direct investment.

- A generally supportive government policy, allowing, for example, duty-free imports of raw materials on the condition they are re-exported as clothing products within 90-120 days; and

- The Vietnamese industry has shown capacity to react quickly and flexibly to new orders.

Opportunities

- Development of ‘non-traditional’ markets for Vietnamese clothing products holds out promise: the industry is looking at the Middle East and Russia as important new opportunities in this regard; and

- Greater product differentiation and specialization may boost margins – for example in functional work-wear, home furnishings, and other niche markets.

Confronted with many challenges

Join TPP, textiles Viet Nam faces many challenges: tariff on (with 0% tax rate) for Textile goods are only applied within 3 years after the TPP was signed and took effect. After 3 years, want to enjoy this tax rate, the participating countries must adhere to the formula TPP TPP posed by the "From yarn forward", meaning that the passage from the stage of spinning, weaving - dyeing - finishing and cuts should be made in the Member States.

For Vietnam, by the end of 2012, the entire textile sector with 5.1 million spindles and about 820,000 tons of used materials (natural cotton 420,000 tons) and fiber types (about 400,000 tonnes). But the textile sector to import 415,000 tonnes of natural cotton (domestic only meet about 1%). About fiber and chemical fiber types must import about 54% (220,000 tonnes). On canvas, 2012, the whole sector employs about 6.8 billion meters of fabric, but domestic production is only 0.8 meters, while the rest is imported. This reality shows that the textile sector, Vietnam is dependent import raw materials from abroad.

"For sewing fabric dyeing - one of the requirements of the TPP, a long time this area is not invested, so now the base of dyed cloth across the country can count on the fingers. Already the world, nearly 100 industrial zones in the country today do not want to receive or lease the premises for construction of dye that the industry is likely to cause environmental pollution, "said Nguyen Dinh Truong. Deputy Chairman of the Association textile acknowledge. Mr. School added difficulty of the textile sector is now the latest technology and equipment is almost zero, because equipment and technology are all imported, which can not be produced. Panorama of the textile sector is now almost 4,000 establishments are only implemented last stitch cut - sewing and finishing (CMT)

Development policy for the sector

The future of the Vietnamese textile industry looks superlative owing to the continuous efforts made by textile companies to upgrade their equipment to enhance their competitiveness. Vietnam's GDP is expected to touch US$ 235 billion by 2025 and the garments and textiles may bring an export turnover of US$ 28.5 billion by 2025. So, construction training human resources for the textile industry, including Vietnam Textile and Apparel Association and the Vietnam Textile and Garment Group is the focal point to coordinate and link with the training facilities at home and abroad - Research and application of new technologies, new materials, and consulting capacity building, research and development, technology transfer, the ability to design and creation of models of the Institute - Focusing on environmental protection, with a focus on dealing with water pollution in the textile dye company, technological innovation in this sector towards fuel economy and environmental friendliness investment in technology and closed process. Representatives of textile facilities in the city like: Corporation HoaTho Textile, Textile Corporation 29-3, Kad Industrial SA Company Vietnam (HoaKhanh Industrial Zone) ... are keen State wanted to take measures to prevent these businesses, which are mainly FDI and private enterprises in Vietnam brought the technology and outdated equipment, have been fully depreciated create competition unfair on the market and labor disturbance in the sector. Simultaneously, the State proposed investment policy soon have strong yarn, dyed to a closed domestic production processes as TPP provisions.

Join TPP, textiles Viet Nam faces many challenges: tariff on (with 0% tax rate) for Textile goods are only applied within 3 years after the TPP was signed and took effect. After 3 years, want to enjoy this tax rate, the participating countries must adhere to the formula TPP TPP posed by the "From yarn forward", meaning that the passage from the stage of spinning, weaving - dyeing - finishing and cuts should be made in the Member States.

For Vietnam, by the end of 2012, the entire textile sector with 5.1 million spindles and about 820,000 tons of used materials (natural cotton 420,000 tons) and fiber types (about 400,000 tonnes). But the textile sector to import 415,000 tonnes of natural cotton (domestic only meet about 1%). About fiber and chemical fiber types must import about 54% (220,000 tonnes). On canvas, 2012, the whole sector employs about 6.8 billion meters of fabric, but domestic production is only 0.8 meters, while the rest is imported. This reality shows that the textile sector, Vietnam is dependent import raw materials from abroad.

"For sewing fabric dyeing - one of the requirements of the TPP, a long time this area is not invested, so now the base of dyed cloth across the country can count on the fingers. Already the world, nearly 100 industrial zones in the country today do not want to receive or lease the premises for construction of dye that the industry is likely to cause environmental pollution, "said Nguyen Dinh Truong. Deputy Chairman of the Association textile acknowledge. Mr. School added difficulty of the textile sector is now the latest technology and equipment is almost zero, because equipment and technology are all imported, which can not be produced. Panorama of the textile sector is now almost 4,000 establishments are only implemented last stitch cut - sewing and finishing (CMT)

Development policy for the sector

The future of the Vietnamese textile industry looks superlative owing to the continuous efforts made by textile companies to upgrade their equipment to enhance their competitiveness. Vietnam's GDP is expected to touch US$ 235 billion by 2025 and the garments and textiles may bring an export turnover of US$ 28.5 billion by 2025. So, construction training human resources for the textile industry, including Vietnam Textile and Apparel Association and the Vietnam Textile and Garment Group is the focal point to coordinate and link with the training facilities at home and abroad - Research and application of new technologies, new materials, and consulting capacity building, research and development, technology transfer, the ability to design and creation of models of the Institute - Focusing on environmental protection, with a focus on dealing with water pollution in the textile dye company, technological innovation in this sector towards fuel economy and environmental friendliness investment in technology and closed process. Representatives of textile facilities in the city like: Corporation HoaTho Textile, Textile Corporation 29-3, Kad Industrial SA Company Vietnam (HoaKhanh Industrial Zone) ... are keen State wanted to take measures to prevent these businesses, which are mainly FDI and private enterprises in Vietnam brought the technology and outdated equipment, have been fully depreciated create competition unfair on the market and labor disturbance in the sector. Simultaneously, the State proposed investment policy soon have strong yarn, dyed to a closed domestic production processes as TPP provisions.

References

- Vietnam National Textile and Garment Group (Vinatex)

- Vietnam Trade Promotion Agency: VIETRADE

- Web portal Vietnam Textile Corporation

- Overview of the Textile and Garment Sector in Vietnam –by Embassy of Denmark in Vietnam

- http://insightalpha.com/news_details.php?cid=189&sid=75&nid=351

- An Overview of Textile Industry in India

- An Overview of the Readymade Garment Industry in India

- Overview of Textile Sector of Pakistan

- Condition of Ready-made Garment (RMG) Sector of Bangladesh

- An Overview of the Bangladesh Ready-Made Garment Industry